[ad_1]

MarioGuti/iStock Unreleased via Getty Images

Lately, I have been focusing on European stocks as the USD has appreciated significantly against the Euro. This led me back to Industria de Diseño Textil (OTCPK:IDEXY) (OTCPK:IDEXF), in short Inditex, a company that I used to own shares of a couple of years ago. In this article, I will go through the company’s business model and explain why this might be a stock that you want to add to your portfolio.

Business model

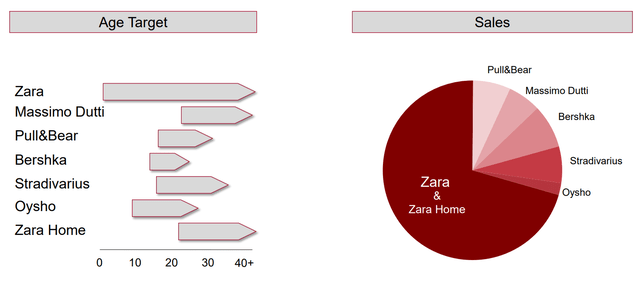

Inditex Group is a retail company that focuses on fast-fashion retail. It sells different styles of clothing which include the latest fashion for men and women (Zara), urban fashion for young women (Stradivarius), business wear for men and women (Massimo Dutti), casual and sports clothing for young men and women (Pull & Bear), the latest fashion for young men and women (Bershka), and lingerie, loungewear, and sports clothing for women (Oysho). Besides clothing, the company also sells home textiles (bed linen, and table cloths among other things) under its Zara Home brand. The brands of Inditex complement each other, as they focus on different age groups and price points. This strategy has made the company the largest fast-fashion retailer in the world by revenue. The company’s main market is its home market of Spain, followed by the US.

Target group by age and revenue per segment (Inditex)

Zara / Zara Home

Zara (incl. Zara Home) is the largest brand of Inditex and accounted for €19.6 billion in sales during FY 21 (approximately 70% of total revenue), and €2.9 billion in profit before tax. The company started the brand in 1975 with a store in A Coruña in Spain. Nowadays the brand’s products are sold in 202 markets and it has stores in 96 countries. The brand is built around 4 keywords: beauty, clarity, functionality, and sustainability. The company doesn’t own the operations of Zara in every country, as approximately 12% of operations are franchised. As an example, the company does not hold full ownership in Zara South Korea and Zara South Africa, but has options to acquire this in the future.

Zara New York (Inditex)

Massimo Dutti

Massimo Dutti sounds like a luxurious Italian brand that sells handmade suits but it has no links to Italy. The company was founded in 1985 by Spaniard Armando Lasauca and became part of Inditex in 1991. The brand focuses on business wear and is slightly more luxurious than Zara (better materials, higher price point). The brand’s products are sold in 186 markets and stores are located in 74 countries. During FY 21 Massimo Dutti accounted for €1.7 billion in sales, making it the 5th largest brand under the Inditex flag.

Massimo Dutti Washington (Inditex)

Pull & Bear

Pull & Bear is the brand for casual fashion and sports styles for young men and women. It was the 3rd largest brand by revenue under the Inditex flag in FY 2021 with a revenue of €1.9 billion. The brand was founded in 1991 and has two different lines, one that is intended for teenagers and the other one that is intended for adults. The clothes of Pull and Bear have a fun styling that fuses international and club influences. Pull & Bear stores can be found in 73 markets, but their products are sold in 185 markets.

Pull & Bear Vienna (Inditex)

Stradivarius

Stradivarius products raked in €1.8 billion in sales in 2021, making it the 4th largest brand of Inditex. The brand was family-owned until Inditex acquired it in 1999 and has been expanding rapidly ever since. Stradivarius focuses on women in the age group of 18 to 35. Its clothes differ slightly from the other brands of Inditex as the focus lies more on Urban fashion. Stradivarius’ clothes are sold in 180 markets and has stores in 66 of those.

Stradivarius Madrid (Inditex)

Bershka

Bershka focuses on the latest fashion for young men and women (age 13

to 23). The brand is the 2nd largest brand of Inditex and had a revenue of €2.2 billion in FY 21. The brand has multiple collaborations with prominent figures from the music scene which include Bad Gyal and Paloma Mami. The brand also has/had collaborations with Naruto (anime), League of Legends (game), and the NBA. The company’s products are sold in 185 markets and stores are located in 73 of them.

Bershka store Taiwan (Inditex)

Oysho

The Oysho brand was founded in 2001 and is the smallest brand within the Inditex Group with a revenue of €600 million in FY 2021. The brand focuses on the latest trends in lingerie, loungewear, and sports styles. Under the Oysho brand, the company also offers sports-related content via its Oysho Train With Us training program. Oysho products are sold in 176 markets and has stores in 57 of them.

Oysho Solna, Sweden (Inditex)

Performance

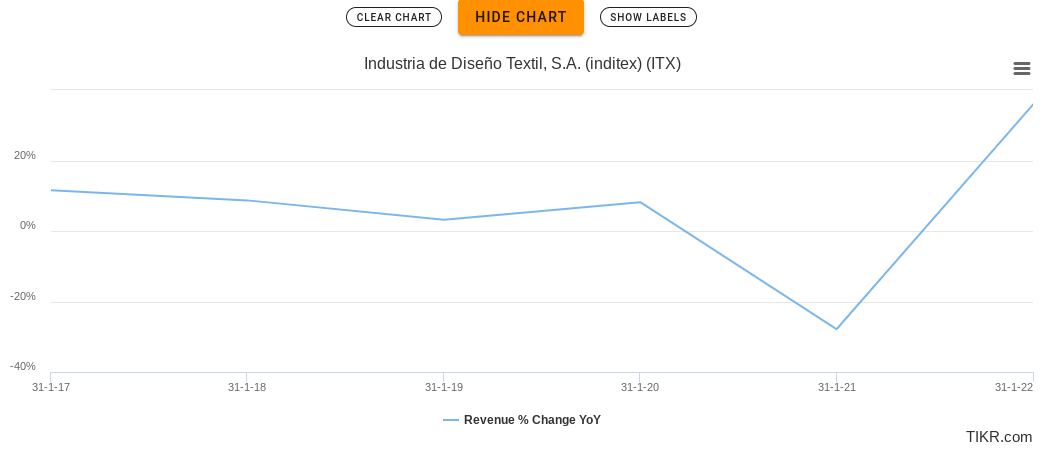

The company has been performing relatively well over the past few years, growing revenue at a 5-year CAGR of 3.5%. The company’s revenue went up 4 out of the past 5 years, with the only year with negative revenue growth being 2020, which was heavily impacted by store closures and corona measures.

5-year revenue growth (Tikr.com)

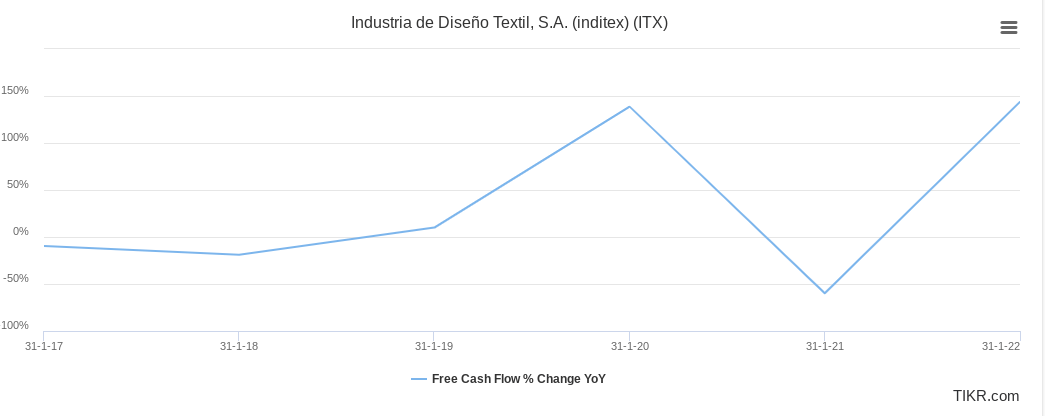

From a free cash flow perspective, the story is slightly different. The company’s FCF CAGR over the past 5 years is 15.8% but the growth has been very volatile. This is partly due to Covid, which led to store closures and additional safety measures, and store optimization. I expect this to be slightly less volatile moving forward as the company has finished its store optimization program.

Free cash flow past 5 years (Tikr.com)

When it comes to return on equity the company has performed very well. The company’s ROE has mostly remained above 20 during the past 5 years, which, in general, is very good. In order to get an even better understanding of the company’s ROE performance, we will compare it with the industry average.

|

FY |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Inditex |

25.7% |

24.5% |

24.6% |

7.5% |

21.4% |

|

Industry |

16.6% | 24.4% | 19.9% | -0.6% | 35.2% |

Source: Tikr.com and NYU Stern

What can be seen in the table is that Inditex is outperforming its industry 4 out of 5 times in the last 5 years. This means that the company is in general more profitable and more efficient in generating revenue than competitors in the same industry.

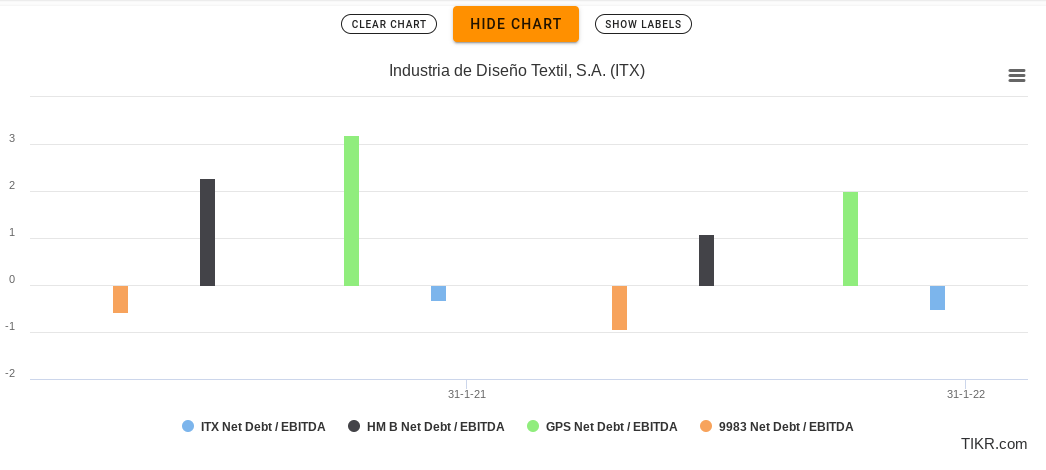

The last thing that I think is important to look at, is the company’s financial health. To do this I prefer to look at the company’s net debt/EBITDA compared to its peers and the company’s debt to equity ratio. This will tell if the company is using excessive debt compared to its peers and its equity financing. When it comes to the debt-to-equity ratio, I like to see a ratio below 100%. This gives the company more room to finance things in the future such as new projects and acquisitions. At the end of FY 21, Inditex had a debt-to-equity ratio of 37.2%, which is below my threshold of 100%.

For the net debt to EBITDA comparison I compared Inditex to H&M,(OTCPK:HNNMY), GAP (GPS), and Fast Retailing (OTCPK:FRCOY). These peers were chosen as they all operate in the fast-fashion industry. If we look at the graph below, we can see that Inditex is the 2nd best company with a net debt to EBITDA of -0.5, trailing Fast Retailing. Nevertheless, given that Inditex’s net debt to EBITDA is under 0, investors shouldn’t worry as the company’s cash position is currently larger than its debt position.

net debt to EBITDA compared to peers (Tikr.com)

Valuation

To put a valuation on Inditex I used 4 different valuation methods: a DCF based on a growth rate in perpetuity, a DCF based on the company’s EV/EBITDA, and the company’s mean LTM PE, and LTM EV/Revenue. The reason why I use 4 different valuation methods is to limit the impact of an overly optimistic or pessimistic model.

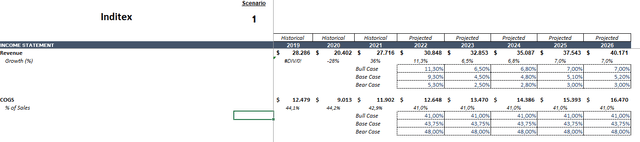

For my DCF models I use multiple scenarios: a bear case, a base case, and a bull case. I use multiple scenarios because it is hard to estimate what the economy is going to do in the next 5 years. The revenue growth that I use is based on the forecasts of analysts, and the COGS is based on the COGS over the past three years and adjusted based on my overall expectation of the company in that environment. For Inditex, this leads to the following results:

Inditex revenue and COGS estimation (Author, Tikr.com)

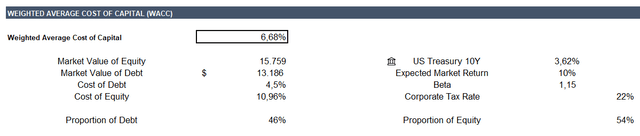

To discount future cash flows, I calculated the company’s weighted average cost of capital (WACC). The WACC is based on the company’s beta, my minimum required rate of return, the treasury rate +0.5% (as I expect this to rise), cost of equity, and cost of debt. I also adjusted the cost of debt upwards to take into account the expected rate hikes by the Fed and ECB. This led to the following WACC estimation:

WACC estimation (Author)

The estimated growth rate in perpetuity is put at 1%, this is below the 10-year US GDP CAGR and below the 10-year European Union GDP CAGR. The reason why it is below the 10-year GDP CAGR is to err on the side of caution. I further assume that approximately 2.5 million shares are bought back annually, which is in line with FY 21 and a dividend payout ratio of 60% (the company’s goal). This gives a price target of approximately €26.80 based on the DCF perpetuity model.

Inditex’s EV/EBITDA has been approximately 17.5 over the past 10 years, given the current market uncertainty I revise this downwards to 16. This still gives me a price target of €36.62 based on the DCF EV/EBITDA model, which is approximately €15 above its current price.

The other valuation methods which I use, the company’s P/E ratio and EV/Revenue are based on the company’s 10-year averages. The company’s 10-year average P/E, after taking out outliers, was 25 and its EPS during FY 2021 was €1.04, which gives a price target of €26. The company’s 10-year EV/Revenue was approximately 3.5 and its 2021 revenue was €27.7 billion. After multiplication, subtracting net debt, and dividing it by the shares outstanding, I get a price target of €31.54.

If we combine all the price targets: €26.80, €36.62, €26.00, and €31.54, we get an average price target of €30.24. This gives an upside of approximately 38% over the price at the moment of writing.

Risks

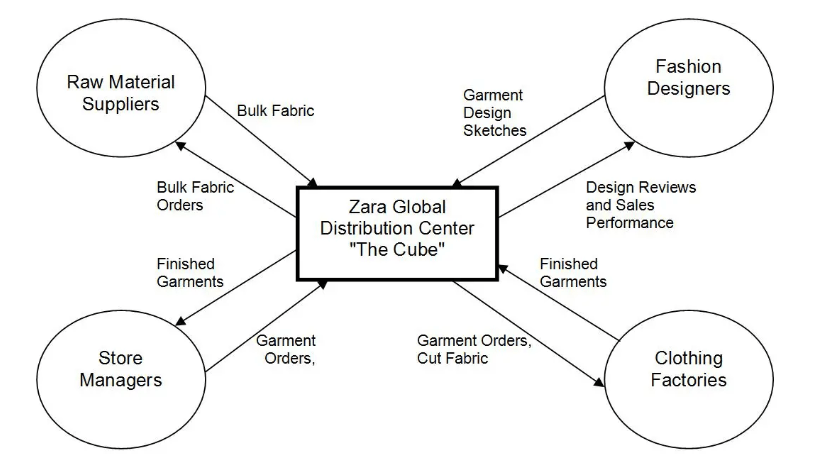

Supply chain

Lately, supply chains have been disrupted by a shortage of labor, and COVID measures in China. A disruption in the supply chain can have a significant impact on Inditex, as most of their goods stay in store for at most 3-6 months. Fortunately, the company has a very strong supply chain model and most suppliers of raw materials can get their goods to the company’s DC within 5 days (mainly by road). Furthermore, the company’s supply chain is highly automated. As an example, the company has automated underground monorails from Zara’s DC to 11 Zara-owned factories, which are all located within a 10-mile radius of the DC. Although this does not take away the risk completely, it helps to mitigate some of the effects of a disrupted supply chain.

illustration of Zara’s supply chain model (SCM Globe)

Fashion

Inditex is active in the fast-fashion retail industry. This means that the company constantly has to update its collection in order to stay on top. Even though the company has managed to do this over the past couple of years, this could change in the coming years. If consumers dislike Inditex’s collection for a couple of quarters in a row this can have a significant effect on the company’s revenue. Nevertheless, Inditex’s factories can quickly increase and decrease production rates if a collection is not popular enough, due to the systems that the company uses. This mitigates some of the risks, but it could still have a significant impact on earnings moving forward.

Other things to take into account

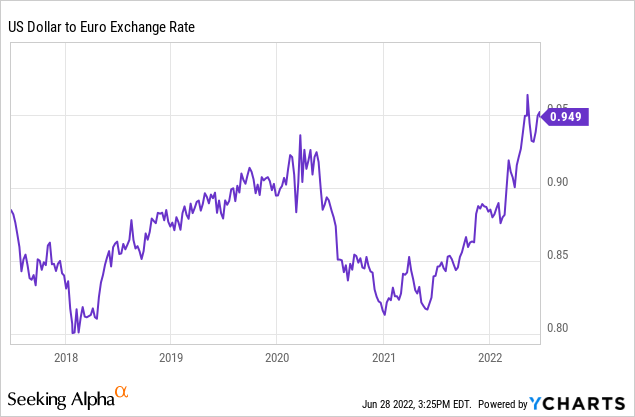

Foreign exchange rate

Inditex is listed on the Spanish stock exchange and its main listing is traded in Euros. A depreciating Euro could have a significant impact on your stock returns. The Dollar is currently trading near its highest level in the past 5 years, which should bode well for investors that have their accounts denominated in USD, as they will get more Euros for their Dollars. If an investor is interested in buying Inditex, it is important to take into account the FX rate and, if deemed necessary, hedge against the depreciation of the Euro against the USD.

Dividend withholding tax

Spain, like many European countries, has a dividend withholding tax. The dividend withholding tax of Spain is currently 19%. However, due to the tax treaty between the US and Spain investors can pay slightly less. The tax treaty states the following:

However, such individuals may also be taxed in the Contracting State of which the company paying the dividends is a resident, and according to the laws of that State, but if the beneficial owner of the dividends is a resident of the other Contracting State, the tax so charged shall not exceed: (A) 10 percent of the gross amount of the dividends if the beneficial owner is a company which owns at least 25 percent of the voting stock of the company paying the dividend; (B) 15 percent of the gross amount of the dividends in all other cases. This paragraph shall not affect the taxation of the company in respect of the profits out of which the dividends are paid.

This means that under the tax treaty investors should have a withholding rate of 15%. I would advise investors that want to know the tax implications of a position in Inditex to contact their tax advisor.

Conclusion

The appreciating Dollar makes European stocks more attractive as investors get more Euros for their Dollars. One company that investors could consider is Inditex. Inditex is the largest fast-fashion retailer in the world and has been growing steadily. The company recently finished its optimization plan and its multi-concept strategy makes its products attractive to the majority of consumers. This can also be seen by its stable revenue growth, efficient operations, and strong financial health. However, there are risks to investing in Inditex, which include disrupted su

pply chains and the constant change in fashion. Additionally, investors have to take into account the foreign exchange rate and withholding tax when buying a stake in Inditex. Overall, I would say that the benefits outweigh the rewards and if investors want to profit from a strong dollar then Inditex might be a good investment.

[ad_2]

Source link

More Stories

What Are the Benefits of Custom-Made Jewelry?

Sabika Necklaces

Celebrities Are Wearing CZ Jewelry