[ad_1]

According to Michigan Retailer Association’s review of retail gross sales introduced in its 2021 Get Nearby Examine, nationwide ecommerce sales grew from 8.8 p.c of full retail gross sales in 2017 to 10.7 percent in 2019, and then jumped again to 13.6 p.c in 2020. Whilst this information is really hard to delineate at a point out-stage, there’s no question that Michigan’s retail sector has probable undergone a identical transformation.

Amid the COVID-19 pandemic, introducing ecommerce as a mode for offering has been significant for quite a few Michigan vendors. Devoid of it, extra merchants would not have survived the pandemic.

As on the internet gross sales improve, so does fraud

As substantially as merchants have benefited from ecommerce revenue, on line credit rating card fraud has jumped noticeably throughout the U.S. In accordance to LexisNexis, U.S. ecommerce merchants claimed a 140 percent improve in fraud attacks considering the fact that 2020. Additionally, in accordance to a recent write-up in Small business Insider, card-not-present (CNP) fraud is predicted to expand by 14 percent in the next 4 many years.

Just one of the most typical ways cyber criminals get stolen credit card quantities is by the darkish internet. Most stop by a internet site on the dim world-wide-web and obtain stolen credit score playing cards in bulk with the aim of screening them to uncover the kinds that get the job done. In 2019, there ended up at minimum 23 million stolen credit card quantities for sale on the dim website. That number has only elevated given that then.

What does this fraud necessarily mean to your organization? Feel extra chargebacks, penalties, missing earnings, and a new standing among criminals that your small business is an straightforward concentrate on.

I say this generally: fraud avoidance is a journey, not a destination. Cyber criminals are quite advanced and they alter methods usually and often. There are, on the other hand, 3 actions you can consider that will assist you prevent fraud throughout a transaction. They can expose a opportunity credit card theft in the producing.

- Do you take discover if your terminal ordeals an EMV chip malfunction?

Although most of this posting is related to ecommerce, a single of the techniques that negative guys use stolen card numbers is by way of a deal with-to-confront transaction that is not “dipped” into the chip reader.

Despite the fact that most retailers use an EMV chip reader, terminals are established up to allow for transactions to be processed applying a magnetic strip to accommodate older cards without chips, or cards with malfunctioning chips. This is the loophole that criminals are now exploiting.

If a negative guy has a very good card quantity (and the associated information from the magazine stripe), they can encode that on a reputable card and then hurt the card’s EMV chip. This will force your terminal to accept a swipe (with the stolen card range on the magazine stripe, in its place of the legitimate card variety).

When they make a buy, they insert the card in the chip reader, which will report an mistake simply because the chip are not able to be browse. Then, they will convey to the clerk that they are obtaining difficulties with the EMV chip on their card and talk to if they can entire the transaction by either swiping the magnetic strip or getting the clerk key in the account variety, bypassing the EMV chip reader all with each other.

Consider take note, you require to be vigilant with your staff members about usually utilizing an EMV chip reader. The key card networks have very clear regulations about this. If a merchant allows a shopper with an EMV chip credit score card to make a buy by swiping the card in lieu of making use of the chip reader, any chargebacks filed towards the transaction will automatically be uncovered in the cardholder’s favor.

Inform your team to get notice when this happens, particularly if it is a substantial-ticket amount this sort of as jewellery, appliances, or a computer. If your EMV chip reader carries on to are unsuccessful, it could be time to enhance your system.

- Does your website need a a few-digit security code for all on-line transactions?

In accordance to a 2021 Nilson Report on credit score card fraud, the quantity of cash misplaced to card-not-present fraud in 2020 was six instances greater than what retailers dropped just 1 year earlier. That’s why the have to have to make confident that any purchases produced on your web-site involve a security code.

A credit rating card stability code, frequently acknowledged as the card verification worth 2(or CVV2) is the three or four -digit code ordinarily identified on the back again of a credit score card. The CVV2 provides an added layer of security by verifying that the purchaser is in possession of the card.

To keep PCI compliant, you are not allowed to keep CVV2 codes on your technique. This allows in shielding clients from a information breach and tends to make it difficult for cyber criminals to get a customer’s CVV2. Not complying with world-wide PCI Info Protection Benchmarks could end result in hefty fines or even worse – the cancellation of your service provider processing access by the payment processor.

- Does your site incorporate a CAPTCHA as section of the checkout procedure?

1 of the complications that terrible fellas have is figuring out if the card figures that they acquired on the dim internet are however energetic and “good.”

A frequent online method used by criminals is obtain web sites to test a group of stolen cards by conducting low-amount transactions, typically $1 or $2 to find the cards that are nonetheless energetic. This type of account testing is identified as “card tumbling.” One particular of the big effects of becoming a sufferer of a card tumbling assault like this is the sizeable costs your account can happen if the scale of the assault is considerable. Some examples of expenses include authorization, clearing and settlement, interchange, and gateway transactions.

Just about anything you can do to sluggish down the process of receiving an authorization try on a transaction keeps card tumblers at bay. This is where like a CAPTCHA as aspect of your online checkout process performs a vital purpose. According to Dictionary.com, the origin of CAPTCHA stands for “completely automated general public Turing exam to notify personal computers and humans apart.” It is a kind of challenge-reaction test used to identify regardless of whether the consumer is a human or a bot. To move the test, customers have to interpret distorted text by typing in suitable letters into a kind subject. In the case of a re-CAPTCHA, the consumer is required to recognize a set of objects in a image.

Even though CAPTCHAs obtain their good share of critics, they’ve done a great task in protecting ecommerce websites from brute power assaults.

As outlined at the starting of this posting, this system of preserving your self is a journey, not a desired destination. It is a thing that you should really be paying out notice to on a regular basis.

As often, if you have concerns about this problem or any other service provider processing problem, be sure to never hesitate to get hold of our buyer provider workforce at 800.563.5981

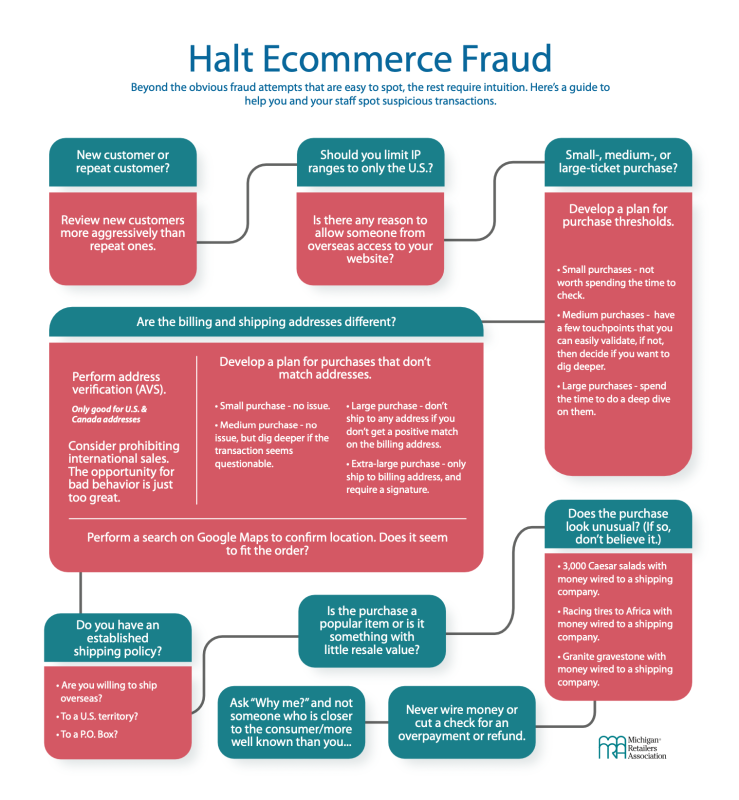

Use this Ecommerce Fraud Final decision Tree graphic to aid you and your employees spot suspicious transactions.

[ad_2]

Resource website link

More Stories

Women’s Jewelry Vs Men’s Jewelry

Diamond Jewelry – The Must-Have and Most Sought-After Thing in Women’s Life

Why Earrings Are a Way to Express Yourself